Incorporating a company in Hong Kong is your gateway to Asia’s vibrant business environment. Hong Kong remains a global hub with streamlined registration processes, low taxation, robust financial infrastructure, and supportive government initiatives.

This guide will walk you through ensuring your journey to establish a business in Hong Kong is smooth and informed.

Benefits of a Hong Kong Company for International Entrepreneurs

Hong Kong is one of the most business-friendly jurisdictions in the world, offering low taxes, full foreign ownership, and seamless incorporation. Whether you're a digital nomad, an e-commerce entrepreneur, or a global startup founder, Hong Kong provides numerous advantages:

1. Low & Simple Tax System

No VAT, no dividend tax, and no capital gains tax

Territorial tax system – Only profits earned within Hong Kong are subject to tax

Potential 0% corporate tax if your business operates entirely outside Hong Kong (i.e., no local customers, suppliers, offices, or employees)

Companies only need to file profit tax annually, simplifying compliance

This is not a loophole but a legal tax exemption, supported by audit reports, tax returns, and assessments.

2. 100% Foreign Ownership – No Local Director Required

Unlike many jurisdictions that impose local director or shareholder requirements, Hong Kong allows full foreign ownership. You do not need a local resident director or partner, ensuring complete control over your business from anywhere in the world.

3. Operate & Manage Your Business Remotely

There is no residency requirement for directors or shareholders, allowing you to incorporate and run your business from anywhere. This makes Hong Kong an ideal choice for:

Digital nomads

E-commerce entrepreneurs

Global startups and international business owners

4. Fast & Efficient Incorporation Process

Company registration can be completed in 1-5 working days

The entire process can be done online, with minimal paperwork

Low government fees and administrative costs compared to other global financial hubs

5. International Banking & Payment Solutions

Hong Kong provides access to:

Multi-currency business accounts for seamless global transactions

International payment gateways like Stripe, PayPal, and Shopify Payments

A growing number of fintech alternatives offering remote account setup

6. Strategic Location & Business-Friendly Regulations

Gateway to China & Asia, with strong trade and logistics advantages

No capital controls, allowing free movement of funds

Transparent legal framework based on English common law

Along with it's proximity to China, as well as to the rest of Asia, Hong Kong provides access to international banking infrastructure, with numerous fintech companies headquartered there offering business accounts with global functionality.

International payment gateways like Stripe, Shopify Payments and PayPal operate independently in Hong Kong and are welcoming to foreign-owned companies.

Want to speak to an expert? Schedule a free consultation with our team: Click Here

Table of Contents

Pre‑Incorporation Considerations

Choosing the Right Corporate Structure

The Incorporation Process: Step‑by‑Step Instruction

Post‑Incorporation Essentials

Employment, Immigration & Funding

Sector‑Specific Guidance & Future Opportunities

Legal, IP & Compliance Considerations

Tips for Starting a Business in Hong Kong

FAQ

1. Pre‑Incorporation Considerations

Before you dive into registration, thorough planning is essential.

Develop a Detailed Business Plan

Vision & Strategy: Define your business model, target markets, and revenue streams.

Market Research: Analyze trends and opportunities in Asia. Leveraging insights from digital transformation can position your business for growth.

Funding & Incentives: Explore government programs like InvestHK and the Technology Incubation Programme for support and R&D access.

Choose Your Operational Model

Onshore vs. Offshore:

Onshore: Enhances local credibility and market presence.

Offshore: Offers tax efficiency if revenue is sourced outside Hong Kong.

Advisory Support: Consult professionals to tailor your corporate structure to your goals.

2. Choosing the Right Corporate Structure

The type of entity you choose affects liability, taxation, and operational flexibility.

Private Limited Company (Preferred Option)

Benefits:

Limited liability protection

Separate legal identity

100% foreign ownership

Attractive tax regime (8.25% on the first HKD 2 million, 16.5% thereafter)

Requirements:

Minimum one director and one company secretary (local resident or licensed service provider)

A registered office in Hong Kong

Other Options

Sole Proprietorship: Simple setup but unlimited liability.

Partnerships: Shared management but joint liability.

Offshore Company: Best for companies with income sourced internationally.

3. The Incorporation Process: Step‑by‑Step Instruction

Follow these steps to incorporate your company in Hong Kong:

1. Choose a Company Name

Key Points:

Ensure the name is unique and not already registered.

English names must end with “Limited” and Chinese names with “有限公司”.

Resources: Use the Companies Registry’s e‑Services Portal or Intellectual Property Department tools.

2. Appoint a Designated Representative (DR)

Role: The DR manages reporting obligations to the and ensures records are updated.

Requirements: Must be a local resident and can be an owner, director, or employee—or a licensed professional.

3. Choose a Company Director

Eligibility:

At least one director is required (no residency requirement).

Must be 18 years or older and have a clean legal record.

Responsibilities: Oversee overall management and act in the company’s best interest.

4. Decide on the Shareholders

Guidelines:

1 to 50 shareholders can be appointed.

Shareholders may be individuals or corporate entities, regardless of residency.

Note: Directors can also be shareholders.

5. Appoint a Company Secretary

Mandatory Requirement: A company secretary ensures compliance with statutory obligations and maintains corporate records.

Restrictions: If you have a sole director/shareholder, they cannot also serve as the secretary.

Tip: Engage a professional service provider if needed.

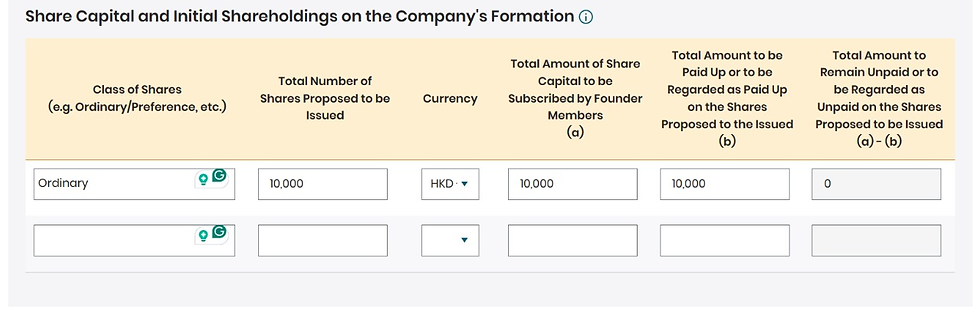

6. Determine Your Share Capital

Overview:

There is no minimum share capital requirement for Private Limited Companies.

Issue at least one share to a shareholder.

Shares can be issued in any major currency.

Calculation: Based on the number of shares and their value.

7. Provide a Registered Address

Requirement:

Must be a physical address in Hong Kong (not a PO Box).

This address is where official mail will be received.

Options: Use a rented office, coworking space, or virtual office provided by a registered agent.

8. File Company Officers’ Details

Public Information: Submit the details of directors, shareholders, and the company secretary to the Companies Registry.

Confidentiality: Options exist (using nominee directors) if privacy is a concern.

9. Hire an Accountant

Importance:

Maintain accurate bookkeeping and submit annual audited accounts to the Inland Revenue Department.

Consider professional accounting services to streamline compliance and tax filings.

Tip: ATHENASIA's accounting services can support your ongoing financial management.

10. Obtain Your Business Registration Certificate

Final Step:

Upon approval, you will receive both the Certificate of Incorporation and the Business Registration Certificate.

The Business Registration Certificate must be renewed annually or every three years.

Display Requirement: It must be prominently displayed at your registered address.

Want to speak to an expert? Schedule a free consultation with our team: Click Here

4. Post‑Incorporation Essentials

After incorporation, maintain smooth operations with these ongoing tasks:

Corporate Banking

Open a Business Account:

Choose a bank that offers multi‑currency options and cross‑border services.

Required documents typically include the Certificate of Incorporation, Business Registration Certificate, Articles of Association, and identification documents.

Annual Compliance & Record‑Keeping

Statutory Returns:

File Annual Returns (e.g., Form NAR1) within 42 days of your incorporation anniversary.

Maintaining Records:

Keep updated registers of directors, shareholders, and significant controllers.

Auditing:

Ensure annual audits are conducted by a certified public accountant (CPA) in Hong Kong.

Renewal Requirements

Business Registration Certificate:

Renew your certificate on time to avoid penalties and ensure continuous compliance.

5. Employment, Immigration & Funding

Hiring & Payroll

Workforce Management:

Familiarize yourself with the Hong Kong Employment Ordinance and related MPF requirements.

Visa Requirements for Foreigners:

Non‑residents can incorporate a company, but may need to apply for an Investment or Employment Visa to work in Hong Kong.

Funding & Government Support

Capital Access:

Explore government grants and funding schemes through InvestHK and related agencies.

Private Investment:

Leverage venture capital and angel investors active in Hong Kong’s thriving market.

6. Sector‑Specific Guidance & Future Opportunities

Hong Kong offers tailored benefits for various industries:

Technology & Innovation

Support Programs:

Access incubation programs and R&D facilities through initiatives like the Technology Incubation Programme.

Digital Infrastructure:

Benefit from advanced IT systems and digital banking services.

Financial & Professional Services

Tax Efficiency:

Enjoy attractive tax rates and a business-friendly regulatory framework.

Global Connectivity:

Utilize Hong Kong’s strategic location as a gateway to Mainland China and other Asian markets.

Trading, Manufacturing & Ecommerce

Logistics & Market Access:

Leverage Hong Kong’s advanced logistics and free‑trade status to expand operations regionally.

7. Legal, Intellectual Property & Compliance considerations

Legal Framework

Regulatory Compliance:

Adhere to the Companies Ordinance and ensure timely filing of statutory returns.

Public Disclosure:

Understand the extent of publicly available information and manage privacy with professional arrangements if needed.

Intellectual Property Protection

Secure Your IP:

Register trademarks, patents, and designs with the Intellectual Property Department to safeguard your innovations.

Stay Informed:

Consult with legal experts on any updates to IP laws and best practices for protection.

8. Tips for Starting a Business in Hong Kong

Develop a Robust Business Plan

Articulate your vision, strategy, and financial projections clearly.

Invest in Your Brand

Build a consistent brand identity across all platforms—logo, message, and visuals—to foster trust and recognition.

Choose the Right Business Structure

Evaluate different entity options (Private Limited Company, Sole Proprietorship, Partnership) to select the one that best suits your needs.

Familiarise Yourself with Official Processes

Stay up‑to‑date on incorporation procedures, document requirements, and deadlines.

Consult with professional advisors to navigate the regulatory landscape.

Leverage Digital Solutions

Utilize online platforms for registration, banking, and compliance to reduce administrative burdens and expedite processes.

Continuously Seek Professional Guidance

Engage corporate secretaries, legal advisors, and accountants for ongoing support and to ensure your business remains compliant.

9. FAQ

Q: What is company incorporation?

A: Company incorporation is the legal process of registering your business to create a separate legal entity with limited liability.

Q: Can foreigners set up a company in Hong Kong?

Q: How long does the incorporation process take?

Q: What ongoing compliance requirements should I expect?

Q: How do I open a business bank account?

Opening a Company in Hong Kong in 2025

Establishing a company in Hong Kong in 2025 offers unmatched opportunities—from low tax rates and streamlined registration to strategic access to Asian markets. By following this step‑by‑step guide, developing a clear business plan, choosing the right structure, and securing ongoing professional support, you set a strong foundation for success.

Athenasia is committed to providing expert guidance throughout your incorporation journey, ensuring that your business thrives in one of the world’s most dynamic financial hubs.

Want to speak to an expert? Schedule a free consultation with our team: Click Here